Navigating the home loan market can be a complex journey, especially when your financial profile doesn't quite fit within traditional loan guidelines. That's where Non-QM Loans come in. In San Diego, these unique financing products provide a pathway to homeownership for individuals who may have been denied by conventional lenders.

Non-QM loans offer a wider range of underwriting standards, taking into account factors beyond your rating. This can be a blessing for those with unique income streams, or who may have experienced financial setbacks.

Whether you're a first-time buyer, exploring Non-QM loans in San Diego is read more worthwhile. With the right guidance, these loans can open doors to your desired location.

Understanding Non-QM Loans in California: A Comprehensive Guide

Purchasing a home in the Golden State can be a rewarding but daunting experience. For borrowers who may not qualify for traditional loan options, Non-QM loans present a viable solution. This guide aims to empower California homebuyers with the knowledge needed to successfully navigate the world of Non-QM loans.

We will delve into the basics of Non-QM lending, analyzing its benefits and potential drawbacks. Furthermore, we'll outline key factors to assess when deciding if a Non-QM loan is the right choice for your circumstances.

- Defining Non-QM Loan Criteria

- Analyzing Your Eligibility

- Identifying Reputable Lenders in California

- Examining Different Non-QM Loan Programs

- Understanding the Application Process

Locating Non-QM Loan Experts Near Me: Get Personalized Mortgage Solutions

Are you a borrower seeking unique mortgage solutions? Traditional loans may not always be the optimal fit for everyone's financial situation. That's where Non-QM loans come in. These adaptable loan programs are designed to cater to borrowers with alternative credit profiles or financial backgrounds.

Finding the right Non-QM loan expert can be crucial for exploring these complex financial products.

- A knowledgeable Non-QM loan expert can help you evaluate if a Non-QM loan is the right choice for your needs.

- Their will also guide you through the application process, explaining all the terms and helping you obtain the best possible mortgage offer.

Don't delay to reach out a Non-QM loan expert near you. They can provide personalized advice tailored to your financial profile, helping you achieve your homeownership dreams.

Understanding Non-QM Loans: When Conventional Doesn't Work

In the world of mortgage lending, conventional loans often serve as the go-to option for many/most/a significant portion of borrowers. However, there are situations where these traditional financing methods prove inadequate. This is where Non-QM (Non-Qualified Mortgage) loans come into play, offering alternative/different/unique financing solutions for those who may struggle to meet conventional lending standards.

- Generally, Non-QM loans are designed for/structured for/tailored to borrowers with unique financial profiles, such as self-employed individuals, those with fluctuating incomes, or those who have/possess/own substantial assets but may lack/might not have/fall short of the conventional/traditional/standard credit history requirements.

- These/Such/Those loans can offer/provide/present greater flexibility/adaptability/latitude in terms of documentation, credit score requirements, and debt-to-income ratios, making them a valuable resource/tool/option for borrowers who might otherwise face/could potentially encounter/would struggle with securing financing through conventional means.

Nevertheless/However/Despite their advantages, Non-QM loans often come with/carry/involve higher interest rates and fees compared to conventional loans. It's crucial for borrowers to carefully consider/thoroughly evaluate/meticulously assess all aspects of a Non-QM loan, including the terms/conditions/provisions, before making a decision/commitment/choice.

Unlocking Homeownership with Non-QM Loans: Eligibility & Benefits

Traditional mortgage lending often has strict guidelines. However, for borrowers who don't meet these benchmarks, there's a alternative: Non-QM loans. These non-traditional financing options can open doors to homeownership for individuals with unique financial profiles.

A key perk of Non-QM loans is their leniency when it comes to income verification. Borrowers may be eligible even if they have non-traditional income sources, recent credit challenges, or less-than-perfect credit scores.

While Non-QM loans offer tailored solutions, it's important to thoroughly evaluate the details of any loan before committing. Factors like fees can vary, so shopping around is essential to secure the best possible deal.

Ultimately, Non-QM loans provide an viable solution for homeownership for those who may not meet the criteria of traditional lending practices.

The Future of Mortgages: Exploring the World of Non-QM Loans

As standardized lending criteria evolve and market conditions fluctuate, the mortgage industry is witnessing a surge in interest towards Non-Qualified Mortgage (Non-QM) loans. These instruments provide an alternative pathway to homeownership for borrowers who may not meet the requirements standardized lending parameters. With its growing popularity, Non-QM lending is poised to revolutionize the mortgage landscape, offering greater availability to homeownership for a varied range of borrowers.

Here's

a closer look at what makes Non-QM loans so attractive:

* **Flexibility:** Non-QM loans often offer higher flexibility in terms of requirements, allowing borrowers with unique financial situations to qualify a mortgage.

* **Alternative : Lenders may utilize alternative information beyond traditional credit scores, such as rental history and bank statements, to gauge borrowers' creditworthiness.

* Product Innovation: Non-QM lenders are constantly developing new products to meet the evolving needs of borrowers.

* **Meeting Market Demands:** As the housing market continues to evolve, Non-QM loans provide a vital option for borrowers who may experience challenges in acquiring financing through traditional means.

}

Although their expanding popularity, it's important for borrowers to carefully evaluate the terms and conditions of Non-QM loans before entering. Working with an experienced mortgage professional who specializes in Non-QM lending can guide borrowers navigate this nuances landscape and find the best solution to meet their individual needs.

Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Tina Louise Then & Now!

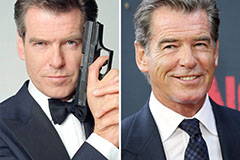

Tina Louise Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!